Alaska residents are set to receive a $1,702 payment in October 2025 through the Permanent Fund Dividend (PFD) program. This long-standing initiative allows eligible Alaskans to share in the state’s oil wealth. The 2025 dividend consists of a standard payment of $1,403.83 and a bonus of $298.17, totaling $1,702 per eligible resident. Below is a detailed look at eligibility requirements, payment dates, and how to apply.

Table of Contents

Understanding the Alaska Permanent Fund Dividend (PFD)

The Alaska Permanent Fund was created in 1976 to ensure that a portion of the state’s oil revenue benefits future generations. Managed by the Alaska Permanent Fund Corporation (APFC), the fund invests in assets like stocks, real estate, and bonds.

Each year, the state distributes 5% of the fund’s earnings as dividends to residents who meet specific criteria. This ensures Alaskans directly benefit from the state’s rich natural resources, regardless of current oil production levels.

Eligibility Criteria

To qualify for the 2025 Alaska PFD, residents must meet these requirements:

- Must be a resident of Alaska from 2024 through 2025.

- Should not have been absent from Alaska for more than 180 days, except for approved reasons such as education, medical treatment, or military service.

- Must have applied between February 1 and April 30, 2025. Late submissions will not be accepted.

- Should not have been convicted of a felony or serious misdemeanor in 2024.

These rules are designed to ensure that only genuine, law-abiding residents receive the annual dividend.

2025 PFD Payment Schedule

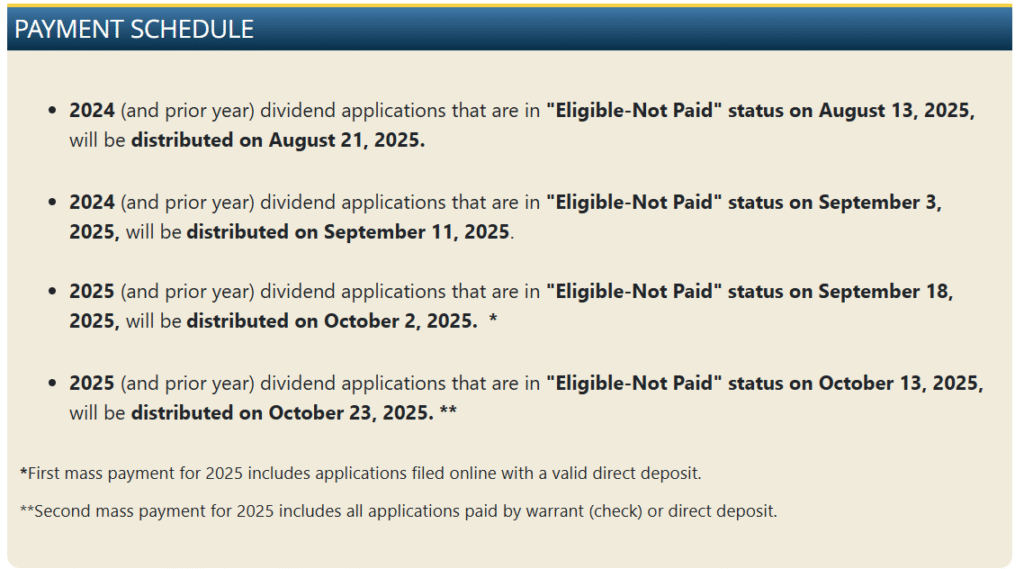

Payments are released based on residents’ application status and eligibility verification. The October 2025 payment schedule is listed below:

| Resident Status | Payment Date |

|---|---|

| Missed payments until 2024 | By September 30, 2025 |

| Missed payments until September 18, 2025 | By October 2, 2025 |

| Missed payments until October 13, 2025 | By October 26, 2025 |

All payments are processed via direct deposit to the applicant’s registered bank account.

Payment Breakdown for 2025

The 2025 dividend totals $1,702 per eligible resident, comprising:

- $1,403.83 – Standard payment portion

- $298.17 – One-time bonus amount

The total dividend may fluctuate each year depending on the Permanent Fund’s investment returns, but the distribution formula of 5% of fund earnings remains consistent.

Updating Your Address or Bank Details

If your mailing address or bank account information has changed, it’s crucial to update your details with the PFD Division before payment deadlines. Incorrect details can delay payments or cause them to be sent to the wrong account.

You can easily update your information by logging in to your myAlaska account at pfd.alaska.gov.

How to Apply for the Alaska PFD 2025

Applying for the dividend is simple, and online applications are processed faster. Follow these steps to apply:

- Visit pfd.alaska.gov and log in using your myAlaska credentials.

- Fill out the application form with your name, address, and proof of Alaska residency.

- Provide accurate banking details for direct deposit.

- Upload scanned copies of all required documents.

- Review your application carefully and submit it before April 30, 2025.

Offline applications can also be submitted through local PFD offices, but online submission is recommended for faster confirmation.

Common Mistakes to Avoid

Many applications are delayed or rejected due to simple errors. Avoid these common mistakes:

- Submitting the form after the deadline.

- Providing incorrect personal or bank information.

- Failing to report absences from Alaska.

- Missing or incomplete proof of residency documents.

Double-check your information before submitting to ensure smooth processing.

Tax Implications of the Alaska PFD

While the PFD is not taxed by the State of Alaska, it is considered taxable income by the IRS. Residents must report the dividend amount when filing federal taxes for 2025.

To avoid tax issues, ensure that withholding and reporting are handled correctly during your federal return filing.

Missed the 2025 Application Deadline?

If you miss the April 30, 2025, deadline, your application will not be accepted. The state does not allow late submissions for any reason. You will need to wait until 2026 to apply again for the next year’s dividend.

Submitting early and keeping your contact details updated is the best way to avoid missing out on your payment.

Conclusion

The $1,702 Alaska PFD payment remains a unique way for residents to benefit from the state’s oil wealth. As the 2025 payout approaches, Alaskans should ensure their details are updated, applications are complete, and tax responsibilities are clear.

This annual dividend not only rewards residents for their connection to Alaska but also symbolizes the state’s commitment to sharing its natural resource prosperity fairly among its people.

FAQs

Q1. When will the 2025 PFD payments be released?

Payments are scheduled between September 30 and October 26, 2025, depending on your application status.

Q2. Is the Alaska PFD payment taxable?

Yes, it’s taxable by the IRS but not by the State of Alaska.

Q3. What is the total amount for 2025?

Each eligible resident will receive $1,702, which includes a bonus of $298.17.